- Credit ratings

- Contacts

-

Choose your country or regionRecommended CountryAfricaEurope & Asia PacificAmericas

Nigeria is our home, we drive her growth. At Stanbic IBTC we seek to support sustainable development in Nigeria, by doing the right business, the right way.

At Stanbic IBTC, we understand that the success of our organisation is inextricably linked to the prosperity and wellbeing of the societies and environments in which we operate.

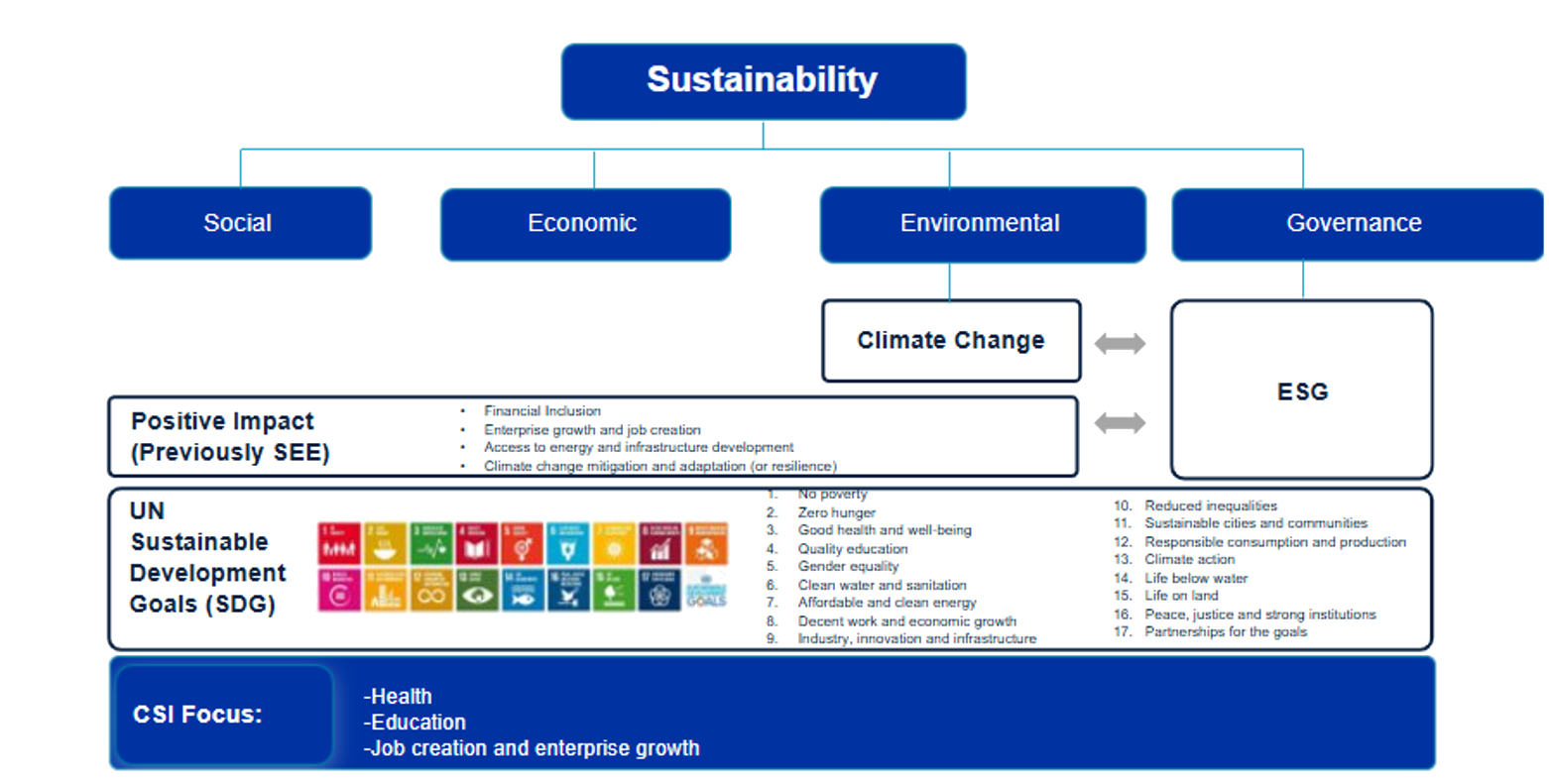

We view sustainability as a synergistic relationship with two facets, which involve optimising our Positive Impact, while addressing and managing Environmental, Social, and Governance (ESG) risks inherent in our business activities. This balanced approach helps us ensure that we operate as a responsible and resilient corporate citizen.

Given our purpose and commitment to solutions that drive your progress, our sustainability strategy focuses on three High Impact Goals (HIGs), which incorporate sustainability as a commercial strategy and best practice of ESG risk management for delivering positive impact.

Our approach is guided by global standards and frameworks.

Our strategic value drivers

The six value drivers encourage not only financial performance but also performance concerning our clients and our employees, how we conduct business, and ultimately, the Social, Environmental, Economic and Governance outcomes for the communities and environments in which we operate. The Positive Impact framework serves as the core of sustainability in Stanbic IBTC.

Our High Impact Goals

Our sustainability purpose statement, ‘”Facilitating Nigeria’s sustainable future” is aligned with our ambition to become the leading financial institution driving sustainable finance solutions in Nigeria. To achieve this, we have thus defined three high impact goals in line with our Positive Impact framework.

This High Impact Goal speaks to the Group’s activities of promoting industrial growth in a way that is environmentally responsible, socially inclusive and economically viable. We demonstrate how sustainability has been integrated whilst ensuring profitability into our lines of business.

Facilitating sustainable trade within the Group involves supporting and promoting trade practices which drive socioeconomic growth and development. We adopt innovative financial solutions such as supporting the growth of the renewable energy sector, fostering job creation, pollution reduction and the mitigation of climate change effects.

Our third High Impact Goal demonstrates how we ensure fair access to finance whilst empowering underserved communities to improve their access to finance and thus create livelihood for these sectors.

Positive Impact Areas

We have identified four impact areas where we believe we can best achieve our purpose (to drive Nigeria’s growth), while positively impacting society, the economy, and the environment. The four Positive impact areas are consistent with the nature of our business and are aligned to the United Nations Sustainable Development Goals (UN SDGS) and the African Union Agenda 2063.

We are dedicated to enhancing job creation and enterprise growth across Africa, by facilitating robust trade and investment while strengthening the agriculture value chain.

- ₦53.4bn in loans disbursed to 2,730 SME clients for the year ended 2024

- ₦8.9bn in credit facilities disbursed to support healthcare service providers

- Facilitated trade solutions valued at over ₦2.1tn for clients in 2024

- Enable Africa’s just energy transition and support improved access to affordable energy

- Provide finance for critical infrastructure in sectors such as transport, water and telecommunications

-

Investment placements valued at ₦34bn made on infrastructure projects during the year 2023.

The Group actively partners with clients, offering sustainable finance solutions to strengthen their resilience and support their transition towards sustainable business practices.

- 56 locations groupwide (42 bank, 2 Head Office campuses, 12 SIPML) run on solar-hybrid powered energy solutions.

- Recycled 196.6 tonnes of waste papers in return for tissue papers in 2024.

- Over 106,000 trees have been planted by the Stanbic IBTC Group.

As we move towards greater financial inclusion and the empowerment of SME owners, particularly women and young people, we are dedicated to providing tailored solutions that encompass access to finance, capacity building, networking and market opportunities.

- Facilitated ₦9.1bn in financing for women operated businesses in 2024.

- 31,828 participants engaged in 1,439 financial awareness sessions within 2024.

- Add a bullet on YLS number of participants

Our sustainability reports

Stanbic IBTC is committed to transparency and effectiveness in our sustainability reporting

-

2024

-

2023

-

2022

-

2021

-

2020

-

2019

-

2018

-

2017

Case Studies

Stanbic IBTC Towers, the new flagship head office for Stanbic IBTC Pension Managers Limited was commissioned on 02 February, 2024. The project achieved a 4-star design stage green building rating from the Green Building Council of South Africa (GBCSA), making it the first building projected in Nigeria registered and certified by the GBCSA.

This prestigious rating reflects Stanbic IBTC’s commitment to environmentally responsible construction and operational pieces. In 2024, the Group reduced water consumption at the Towers by 51%. We have realized a notable 7% year-on-year reduction in energy consumption at our head office campuses

The Green Building features a dedicated lifestyle floor, promoting employee wellbeing through the gym, creche, lactorium (mother’s room), and wellness center.

In October 2024, Stanbic IBTC Bank secured a loan of up to $40mn from FinDev Canada, Canada’s development finance institution. This partnership aims to expand access to financing or refinancing of green, social and sustainable finance projects in Nigeria while supporting key sectors like agribusiness, healthcare, education and sustainable infrastructure.

The loan will support Stanbic IBTC’s sustainability initiatives and empower micro, small, and medium sized enterprises (MSMSEs), with a focus on at least 30% dedicated to women owned or women-led businesses.

Stanbic IBTC’s interventionist programme and flagship corporate social investment (CSI) project Together4ALimb, has continued to give hope and transform the loves of children living with limb loss from congenital issues or birth defects, accidents, or mismanaged injuries across the country.

In 2024, Stanbic IBTC provided prosthetic limbs for 36 children from different communities in Nigeria making a total of 136 beneficiaries in ten years who have received the support. The beneficiaries were also awarded an Educational Trust worth ₦1.5 million each to access quality education.

The Stanbic IBTC Staff Volunteerism initiative encourages staff members in various departments across the organisation to voluntarily pool funds for donations to worthy causes aligned to our CSI areas. The organisation provides an additional donation matching the total funds pooled by staff, and the combined amount is deployed towards the execution of the CSI project selected by staff.

In 2024, total donations from staff volunteerism, including matching funds amounted to over ₦264.5mn.

Stanbic IBTC demonstrated its commitment to sustainable finance by providing a ₦12.6bn Sustainability Linked Borrowing Base Facility to M-KOPA Solar Nigeria Limited, a leading fintech provider focused on asset financing for underserved communities.

M-KOPA empowers individuals in Sub Saharan Africa by offering affordable financing for smartphones and digital financial services through an innovative repayment model.

The facility incorporates key Sustainability Performance Targets (SPTs) related to financial inclusion, clean energy and gender equality, reflecting Stanbic IBTC’s ESG commitment.

Our commitment to sustainability is integral to our mission and operations. This is exemplified through our extensive tree planting initiatives. In 2024, Stanbic IBTC partnered with One Tree Planted to plant 62,180 trees and restore 201 hectares of degraded land in the Afi Mountain Wildlife Sanctuary of Nigeria.

The Afi Sanctuary, home to rare species such as the Cross River Gorilla, has experienced significant deforestation, leading to habitat loss and biodiversity decline.

Through reforestation, this project connects critical wildlife corridors and movement, as well as improves the ecological health of the sanctuary.

Publications

Awards

Stanbic IBTC will never ask for your RSA, PIN, OTP, Full card PAN or Online Login details (Customer ID, BVN or Password) via email, pop-up windows or phone calls.

Please stay safe and remain vigilant. If you receive any suspicious call or notification, contact customer care immediately on 0700 909 909 909 or email [email protected].