- Credit ratings

- Contacts

-

Choose your country or regionRecommended CountryAfricaEurope & Asia PacificAmericas

Our Vision

To be the leading end-to-end financial solutions provider

in Nigeria through innovative and customer-focused people.

Total assets as at 31 December 2024 grew by 34% to ₦6.9 trillion from ₦5.2 trillion in December 2023 while operating income grew by 82% to ₦646.8 billion in 2024.

The Bank on the other hand, was Investment Banking & Trust Company Limited (“IBTC”), a private limited liability company, on 02 February 1989. IBTC was granted a merchant banking license in February 1989 and commenced operations on 01 March 1989. IBTC’s merchant banking license was converted to a universal banking license in January 2002, pursuant to the universal banking guidelines of the Central Bank of Nigeria (“CBN”). In 2005, IBTC became a public company, and its shares were listed on NGX.

In December 2005, IBTC merged with Chartered Bank PLC and Regent Bank PLC and changed its name to IBTC Chartered Bank PLC (“IBTC Chartered”) on 25 January 2006. On 24 September 2007, IBTC Chartered merged with Stanbic Bank Nigeria Limited (“Stanbic Bank”), a wholly owned subsidiary of Stanbic Africa Holdings Limited (“SAHL”), which in turn is a wholly owned subsidiary of Standard Bank Group Limited of South Africa. As part of the transaction that resulted in the combination of IBTC Chartered and Stanbic Bank, SAHL acquired a majority equity stake (50.1%) in the enlarged bank, which was named Stanbic IBTC Bank Limited.

On 01 November 2012, the Stanbic IBTC Group officially adopted a Holding Company (“Holdco”) structure in compliance with CBN Regulation 3 of 2010, which requires banks to divest from non-core banking businesses or adopt a Holdco structure.

Under the current structure, the subsidiaries are: Stanbic IBTC Bank Limited, Stanbic IBTC Pension Managers Limited, Stanbic IBTC Asset Management Limited, Stanbic IBTC Capital Limited, Stanbic IBTC Insurance Limited, Stanbic IBTC Stockbrokers Limited, Stanbic IBTC Ventures Limited, Stanbic IBTC Insurance Brokers Limited, Stanbic IBTC Trustees Limited, Zest Payments Limited and one indirect subsidiary, namely: Stanbic IBTC Nominees Limited.

-

Our strategy

-

Our history

-

Our performance

To be within the top 5 in market share, ROE and service across our major client segments-Personal and Private Banking, Business and Commercial Banking, Corporate and Investment Banking and Insurance and Asset management.

Stanbic IBTC Holdings PLC (“Stanbic IBTC”) was incorporated as a Public Limited Liability Company on 14 March 2012. Stanbic IBTC is the holding company for the entire Stanbic IBTC Group and its subsidiaries. The Company was listed on the Floor of The Nigerian Exchange Limited (NGX formerly The Nigerian Stock Exchange) on 23 November 2012, following the delisting of Stanbic IBTC’s erstwhile holding company, Stanbic IBTC Bank Limited (“the Bank”), pursuant to its compliance with the CBN Regulation on Banking and Ancillary Matters No. 3 of 2010.

The Bank on the other hand, was Investment Banking & Trust Company Limited (“IBTC”), a private limited liability company, on 02 February 1989. IBTC was granted a merchant banking license in February 1989 and commenced operations on 01 March 1989. IBTC’s merchant banking license was converted to a universal banking license in January 2002, pursuant to the universal banking guidelines of the Central Bank of Nigeria (“CBN”). In 2005, IBTC became a public company, and its shares were listed on NGX.

In December 2005, IBTC merged with Chartered Bank PLC and Regent Bank PLC and changed its name to IBTC Chartered Bank PLC (“IBTC Chartered”) on 25 January 2006. On 24 September 2007, IBTC Chartered merged with Stanbic Bank Nigeria Limited (“Stanbic Bank”), a wholly owned subsidiary of Stanbic Africa Holdings Limited (“SAHL”), which in turn is a wholly owned subsidiary of Standard Bank Group Limited of South Africa. As part of the transaction that resulted in the combination of IBTC Chartered and Stanbic Bank, SAHL acquired a majority equity stake (50.1%) in the enlarged bank, which was named Stanbic IBTC Bank Limited.

On 01 November 2012, the Stanbic IBTC Group officially adopted a Holding Company (“Holdco”) structure in compliance with CBN Regulation 3 of 2010, which requires banks to divest from non-core banking businesses or adopt a Holdco structure.

Under the current structure, the subsidiaries are: Stanbic IBTC Bank Limited, Stanbic IBTC Pension Managers Limited, Stanbic IBTC Asset Management Limited, Stanbic IBTC Capital Limited, Stanbic IBTC Insurance Limited, Stanbic IBTC Stockbrokers Limited, Stanbic IBTC Ventures Limited, Stanbic IBTC Insurance Brokers Limited, Stanbic IBTC Trustees Limited, Zest Payments Limited and one indirect subsidiary, namely: Stanbic IBTC Nominees Limited.

Total assets as at 31 December 2024 grew by 34% to ₦6.9 trillion from ₦5.2 trillion in December 2023 while operating income grew by 82% to ₦646.8 billion in 2024.

Our values

We do everything in our power to ensure that we provide our clients with the products, services and solutions to suit their needs, provided that everything we do for them is based on sound business principles.

We encourage and help our people to develop to their full potential and measure our leaders on how well they grow and challenge the people they lead.

We, and all aspects of our work, are interdependent. We appreciate that as teams we can achieve much greater things than as individuals. We value teams within and across business units, divisions and countries.

We have confidence in our ability to achieve ambitious goals and we celebrate success, but we are careful never to allow ourselves to become complacent or arrogant.

We understand that we earn the right to exist by providing appropriate long-term returns to our shareholders. We try extremely hard to meet our various targets and deliver on our commitments.

We encourage and help our people to develop to their full potential and measure our leaders on how well they grow and challenge the people they lead.

We strive to stay ahead by anticipating rather than reacting, but our actions are always carefully considered.

Our entire business model is based on trust and integrity as perceived by our stakeholders, especially our clients.

A diversified and integrated financial solutions offering

Private and Personal Banking provides end-to-end retail solutions to our customers - including lending, transactional banking, and card products.

The Business and Commercial Banking segment serves small and medium enterprises as well as national corporates.

Corporate and investment banking services to government, parastatals, larger corporates, financial institutions and international counter-parties.

Investment management in form of asset management, pension fund administration, trusteeship and insurance brokerage.

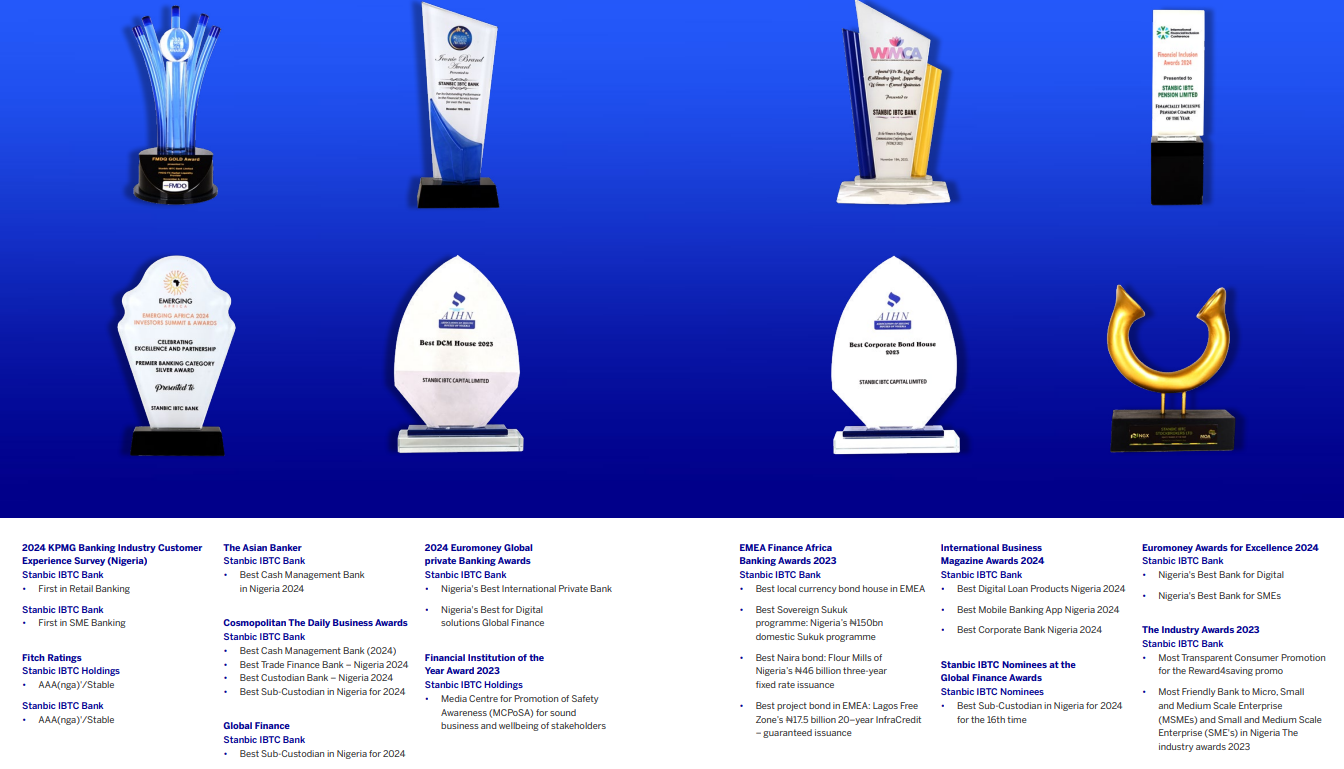

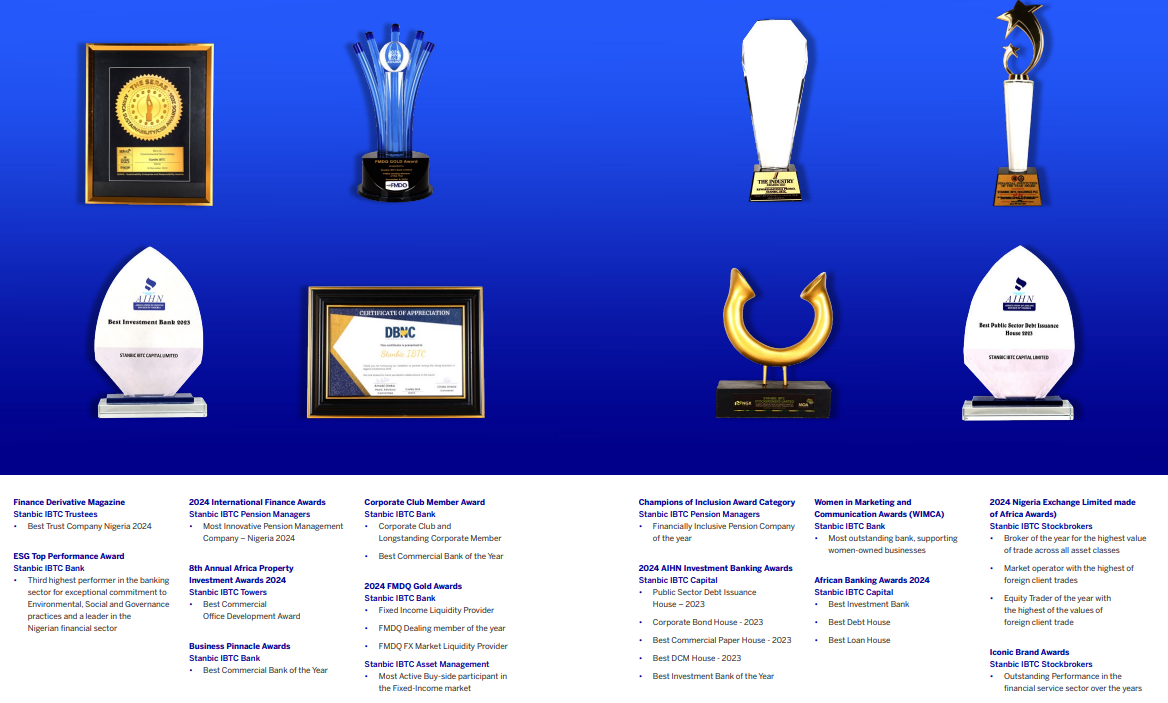

Recognition

Stanbic IBTC will never ask for your RSA, PIN, OTP, Full card PAN or Online Login details (Customer ID, BVN or Password) via email, pop-up windows or phone calls.

Please stay safe and remain vigilant. If you receive any suspicious call or notification, contact customer care immediately on 0700 909 909 909 or email [email protected].